PHOENIX — The Arizona Corporation Commission has already begun hearing public comments about whether they should allow the utility-monopoly APS to increase rates for customers later this year.

Now, some consumer advocates, including the former Chair of the Arizona Corporation Commission, are raising concerns again after learning of additional private meetings between Wall Street investors and Commissioner Kevin Thompson.

In response to questions about the meetings, a spokesperson for Thompson tells 12News commissioners are allowed to communicate with “subject matter experts,” that available records confirm Thompson acted appropriately, and criticism of Thompson amounts to theater.

“No ex parte communications occurred and the record you cite is very clear that there were no discussions about open rate cases or specific utilities,” said Ryan Anderson, Policy Advisor for Thompson. “Similar complaints by activists were already determined to be unfounded political theater.”

Meetings with J.P. Morgan, BofA and Guggenheim

This week, the I-Team obtained several hundred pages of emails and other documents in a public records request. None of the records reviewed by 12News contain evidence Thompson discussed the ongoing APS rate case with investors.

They show that in addition to January meetings in New York between investors and Thompson, there were three additional private meetings in February between Thompson and J.P. Morgan, Bank of America and Guggenheim. All three firms were also involved in the January meetings in New York.

Critics have alleged such meetings amount to a potential violation of “ex parte” rules because there are two open rate cases involving APS and TEP.

“Ex-parte communications is a serious matter. Even if it contains just the suggestion of impropriety, that’s a serious matter,” said Tom Ryan, an attorney who advocates for public transparency. “This commissioner is supposed to be a judge. Imagine you were in a case where the judge is out talking to the other side and you don’t know what is being said. That is not anything that promotes confidence in that judge.”

According to the Arizona Corporation Commission, an “ex parte” communication is “a written or oral communication between a decisionmaker and any person concerning the merits of contested proceeding or linesiting that does not occur in a public forum.”

The ex parte law states its purpose is to avoid “the possibility of prejudice, real or apparent.”

According to the National Council on Electricity Policy, meetings between commissioners and investors help each side understand the other’s position with greater clarity.

“The interests of customers can be served… by open communication between investors and public utilities commissioners,” the organization states.

However, it also notes, “…there are some challenges… Among the most impactful are ex-parte restrictions… communication that is made without proper notice to all parties and not on the public record… Commissioners are restricted by statute from discussing certain topics related to an open proceeding.”

To what degree of specificity those topics can be discussed seems to be a key point of debate.

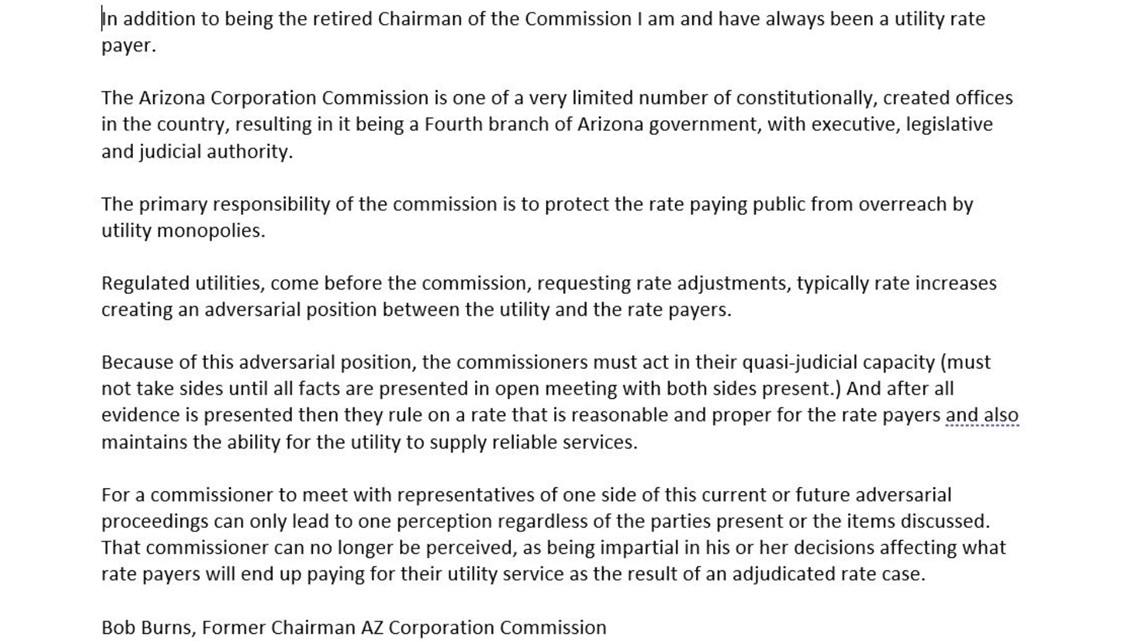

Burns: Thompson cannot be perceived as being impartial

Former Commission Chair Bob Burns reviewed details of records of Thompson’s private visits with investors and a previous statement by Thompson about the purpose of his meetings with investors.

Burns said he believes the meetings warrant further investigation. See his full statement to 12News here:

Current Chair Jim O’Connor and Myers have defended Thompson

In February, the I-Team first reported about an ethics complaint filed at the commission against Thompson after Thompson posted on social media he had traveled to New York and met with investors.

"I spent two days this past week in NY meeting with financial institutions that invest in Arizona's utilities,” Thompson posted on social media on January 21. "My purpose was to let them know that Arizona is a great place in which to invest, and that the Arizona Corporation Commission is no longer going to allow the regulatory environment in Arizona to be dead last in the nation."

Nick Myers, also new to the Commission, commented on Thompson’s post.

“Amen brotha,” Myers wrote.

In March, Corporation Commission Chair Jim O’Connor said there was zero evidence Thompson acted inappropriately during the private meetings and called the complaint filed “weaponization of the code of conduct.”

“The current code of ethics was created during a time the commission was experiencing real corruption,” O’Connor said. “These are very different times. This board is indeed above reproach.”

Thompson said his character was unfairly attacked and he felt it was his duty to assure the investment community that there is regulatory stability in Arizona.

The commissioners voted 3-0-1 not to investigate the matter further.

“On the face of it, no cause for alarm”

The new records released contain one email in which a research analyst from J.P. Morgan wrote to Thompson, “We would appreciate your participation to discuss high-level state and national regulatory topics. We recognize the sensitive nature of utility regulation and will keep the discussion strictly within the bounds of your choosing. Also, these meetings will NOT be recorded, nor will they be open to the public.”

According to the National Association of Regulatory Utility Commissioners (NARUC), an off-the-record discussion between a commissioner and investors does not raise concerns.

“On the face of it, we have no cause for alarm. Some participants may have concerns that segments of recorded conversations are taken out of context and not presented completely, which could misconstrue the intended meaning of those comments,” said Regina Davis of NARUC. “Barring specific prohibitions within their commissions, discussions between commissioners and investment groups can be fruitful, allowing regulators to educate investors on their general perspectives and for investors to articulate the considerations that determine utility ratings.”

NARUC’s policy also stipulates that individual state code of ethics should guide decisions by commissioners.

According to the Arizona Corporation Commission’s Code of Ethics, Rule 5.2 states, “A Commissioner shall not knowingly communicate with any person, representing an industry or public service corporation whose interests will be affected by commission decisions, and whose intent is to influence any decision, legislation, policy, or rulemaking unless that person has registered as a lobbyist.”

“These are fundamentally substantive matters”

In a subsequent email, Jeremy B. Tonet, Executive Director of Global Equity Research for J.P. Morgan, provided Commissioner Thompson with proposed discussion points. They include questions about “current customer rate levels,” “impact of interest rates on ROEs,” “other rate making discussions you would highlight,” environmental policy, the IRA, gas versus electric, and Arizona’s broader transmission needs. The email also states, “Should electric utilities be able to invest in EV infra, batteries, or similar distribution type investments?” It also asks to what extent investor-owned utilities should address commercial adoption of consumer-owned distributed energy resources, and it mentions “consideration for performance-based ratemaking.”

Consumer advocate Abhay Padgaonkar filed the initial complaint against Thompson and said the subjects mentioned in the records are concerning.

“The financial metrics that they brought up over and over like ROE, like the riders, the capital expenses, these are fundamentally substantive matters in a rate case,” Padgaonkar said.

A January 25th email from Guggenheim Partners invites Thompson and Myers to an “Arizona-focused” conference call with investors, “so they might have a better opportunity to hear from you directly about your views and goals as commissioners,” the email states.

Thompson and Myers agreed to meet with Guggenheim and scheduled a meeting.

A Guggenheim representative later sent a statement to Thompson and Myers “as part of our compliance process.” It states, “By agreeing to participate in this event it is our understanding that you will not provide Guggenheim and its investing clients with non-public information that is confidential in nature or which in any way would restrict such an investor from making investment decisions in the public markets.”

A Bank of America compliance statement read in part, “By participating you will not be breaching any agreement, obligation or duty or confidence owed to any person; any matters you discuss or information you provide (by any means) during an Event shall solely be based on publicly available information; and you will not discuss any matter or provide any information (by any means) that is confidential or which would be a violation of any laws or regulations.”

Still no comment from corporation commission director and chief ethics officer

Since February 12News has asked for a comment from the ACC’s Executive Director and Senior Chief Counsel about how the ethics complaint against Thompson was handled and why private meetings with utility investors during an open rate case do not constitute an ethics violation.

The ACC has not responded. A spokesperson for the ACC told 12News on Thursday afternoon the ACC was preparing a statement. As of Thursday evening, the ACC had not provided one.

“The Chief Division Counsel also serves as the chief ethics officer for the commission and that person right now is failing to act as the ethical guardrail she was hired to be,” said attorney Tom Ryan.

Ryan filed a complaint against a commissioner eight years ago that eventually resulted in the commissioner’s resignation. He said the public deserves a response from leadership at the ACC.

“The Attorney General of this state should be notified of this ethical misconduct and should be asked to investigate because clearly, the chief ethics officer is failing in her position right now,” Ryan said.

Credit Suisse research bulletin described a New York meeting

None of the records reviewed by 12News contain direct evidence Thompson discussed the APS rate case with investors.

The records include a Credit Suisse Research Bulletin stemming from one of the New York meetings. It stated Commissioner Thompson believed the regulatory environment was becoming more constructive with newly elected commissioners in the state. It also stated: “We continue to see more evidence supporting the AZ regulatory environment taking more favorable stances than before from an investor’s perspective, but dually stress it’s a 5-member commission making decisions.”

Another portion of the bulletin states, “Commission conversations, specifically AZ mentioned customers in the state are putting reliability ahead of affordability though we stress the two are clearly intertwined.”

It added that Commissioner Thompson’s view is ROE should be used more for penalizing wrongdoings as opposed to rewarding for reliable service. Thompson “also indicated he sees more political pressure potentially arising from voters if performance-based rate making is implemented, which could lead to higher ROE and retail rates.”

Regarding renewable ownership opportunities, the bulletin stated, “Commissioner Thompson indicated he does not want to see utilities forced to purchase projects by developers that don’t offer curtailment options citing issues with CA utilities and load management.” The report adds: “We are watching the APS rate case closely given the renewable rider proposed which would bolster capex prospects for PNW but didn’t see a read-across either way to ownership in our meeting.”

Up to Speed

Catch up on the latest news and stories on the 12News YouTube channel. Subscribe today.