PHOENIX — The average Arizonan paid 15 times more in federal income tax than the president of the United States.

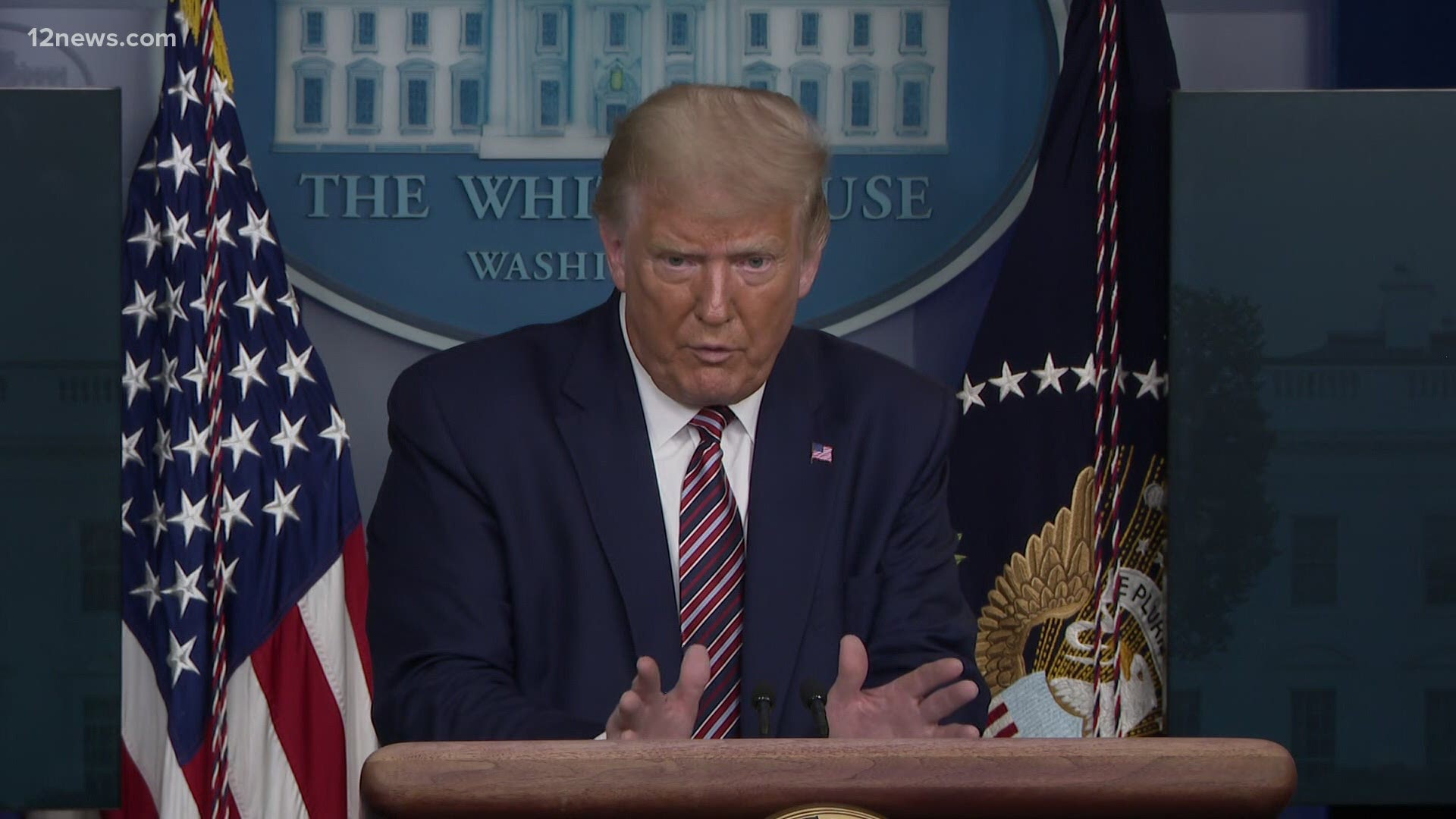

A New York Times report released details on President Donald Trump’s long-sought after tax returns.

According to the Times, the president paid no federal income taxes in 10 of the 15 years they had data and paid a total of $750 in 2016 and 2017.

“Look, the tax law is bizarre, OK? It’s the most complex set of laws in the world,” Tom Wheelwright, CPA and Author of “Tax-Free Wealth,” said.

“If you are a wage earner, you pay high tax, if you are a business owner or investor, you pay low tax.”

Experts said the president’s low-income tax is linked to his profession as a real estate mogul and business owner, allowing him to take advantage of different tax breaks compared to the average, wage-earning Arizonan.

Wheelwright said he wasn’t surprised by the revelations.

“That he would ever pay much in the way of taxes would be shocking for me,” Wheelwright said.

According to Wheelwright, the tax code allows business owners to use losses in years to reduce or eliminate tax hits. According to the Times, Trump’s failed business dealings and properties that have hemorrhaged money have provided the ability to reduce any ability to be taxed federally.

“These aren’t loopholes, these aren’t shenanigans, this is how Congress wrote the law,” Wheelwright said.

In essence, the tax law is set up to incentivize business and development. According to the Times, the president deducted expenses like $70,000 for hair cuts as business expenses.

However, the law has gray area.

“Where it is a grayer area you will see people manipulate it more,” Dr. Jenny Brown, an accounting professor at ASU, said. “There is no bright line, like OK, we crossed it.”

The president is not the only one to avoid paying federal taxes despite bringing in money.

Data from the IRS showed back in 2018 that 5,830 of tax returns showing over a million in family income of those 5,820 reported taxable income. That means at least 10 filings did not report taxable income despite reporting more than a million dollars on their tax returns.

Wheelwright said the number of those not paying taxes is likely even higher, as the returns only show those who show reported income of over a million dollars after deductions.

The question for the president is if he crossed any line. As the Times reported, claiming losses on tax forms while portraying a public image of success.

“As those two measures get further and further apart, legitimizing why they are two measures of the same economic activity gets harder and harder," Brown said.

Both Wheelwright and Brown said it would be hard to tell if there were illegal activities from Trump’s tax returns alone.

“You can look at an individual's tax returns and say if they did something legal or illegal and it’s pretty obvious," Wheelwright said.

"For a business owner's tax returns, that’s why you have the IRS. That’s why you have audits.”

The president is the subject of an audit. According to the New York Times, the audit is based on an almost $93 million tax refund the president claimed at the tail end of the Great Recession.

The president is not the first candidate or president to come under scrutiny for their taxes. A 2012 Republican candidate caught some backlash to paying a lower tax rate during his presidential run.

“When we look at other presidential candidates' returns we always see something.” Brown said. “Do we see this scope? I don’t think so.“